Due to the boost from the AI wave and strong financial reports, the US and Japanese stocks continued to strengthen in the two trading days before the A-share market holiday, with the S&P 500 index once breaking through 5,000 points, and the Nikkei 225 index once breaking through 38,000 points.

In fact, we have always been puzzled that the Federal Reserve had already denied the possibility of a rate cut in March at the interest rate meeting in February, and the earliest rate cut would be in May. However, the market seems not to take Powell's statement to heart and continues to be overly optimistic. With the resilience of the US economy, coupled with the wealth effect brought by the bull market in stocks, it seems difficult for US inflation to decline rapidly again. Finally, last night, the market was severely slapped by the US January CPI, and the US market encountered a rare stock and bond double kill in recent months. The market's expectations for the Federal Reserve's rate cut have also been greatly adjusted to align with the Federal Reserve's dot plot. It seems that the Federal Reserve has won this round of competition with the market.

Specifically, the report released by the US Department of Labor last night showed that the US January CPI increased by 3.1% year-on-year, higher than the market's average expectation of 2.9%, which made people's hopes for the US CPI data to fall back to the "2 era" dashed. At the same time, the core CPI that the Federal Reserve values most increased by 3.9% year-on-year in January, higher than the market's expectation of 3.7%.

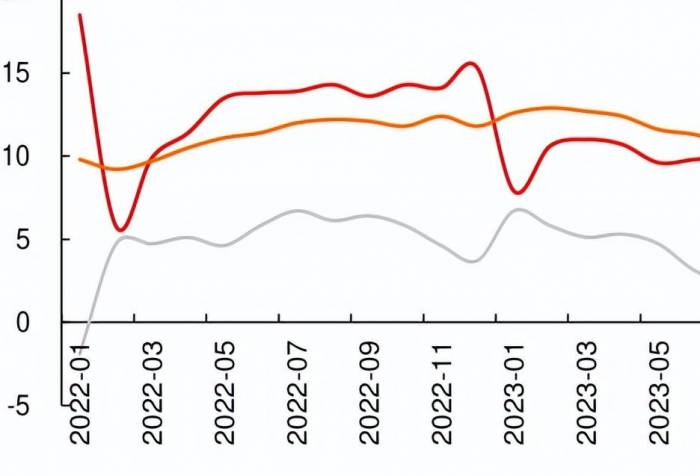

It can be seen that since June 2023, the US CPI has basically remained in the range of 3% to 4%, and has never fallen below 3%. The US core CPI has also bid farewell to the previous trend of rapid decline, with the year-on-year growth rate in January being the same as in December last year, indicating that US inflation may have entered a new sticky stage.

After the data was announced, the market quickly adjusted its expectations for the subsequent Federal Reserve rate cuts, and US short-term interest rate futures traders have bet that the Federal Reserve will not cut rates before June. The FedWatch tool of the Chicago Mercantile Exchange shows that the market currently expects the June meeting to be the most likely time for the Federal Reserve's first rate cut, with a probability of at least 25 basis points of rate cut at that meeting of 74.4%, and the probability of a rate cut at the May meeting has dropped from 60.7% on Monday to 36.1%. The number of rate cuts has also been adjusted from the previous expectation of 6 times to less than 4 times for the whole year.

Due to the significant adjustment of the market's expectations for the Federal Reserve's rate cut, the US dollar index and the yield on US ten-year bonds soared last night, with the US dollar index approaching the 105 mark, and the yield on US ten-year bonds once breaking through the 4.3% mark.

The US market finally ushered in a stock and bond double kill, with the soaring yield on Treasury bonds leading to a bond market crash, the Dow Jones Industrial Average fell by 1.35%, and the Nasdaq fell by 1.80%. At the same time, gold also plummeted, with the international gold price once falling below $2,000 per ounce.

The poor performance of the US stock market last night also dragged down the Asia-Pacific stock market today, with a general decline. However, although the Hong Kong stock market opened with a sharp drop, it was pulled up during the day,Based on our past experiences, the Hong Kong stock market has often played a role of going with the flow during the A-share market's closure, especially in the last two years when the Hong Kong market has been on the decline. It generally does not rise as much as the US stock market but falls more. The yield on the US ten-year Treasury bonds has a significant impact on the Hong Kong stock market. Therefore, today's strong performance of the Hong Kong stock market against the market can be said to be a sign of strength when it should be weak.

We believe there are two main reasons for this:

First, while the global markets continue to reach new highs, A-shares and Hong Kong stocks have experienced accelerated sharp declines. Although it may seem ironic to say that "declines release risk," the plunge in January did indeed further release risks. The valuation of Hong Kong stocks is at a historical low, and share buybacks have reached new highs, making it an attractive choice for contrarian funds. In fact, since January, foreign capital has been accelerating the bottom-fishing of Chinese assets.

Second, the social financing in January started with a bang, with both the total amount and structure showing some optimistic marginal changes. In terms of total amount, China's January social financing scale and credit increase both exceeded market expectations and soared to record highs. Looking at the structure, the January credit increase showed a year-on-year increase on the residential side and a decrease on the corporate side. Specifically, household loans increased by 980.1 billion yuan, with an additional increase of about 72.29 billion yuan year-on-year. Among them, short-term loans increased by 35.28 billion yuan, and long-term loans increased by 62.72 billion yuan, with additional year-on-year increases of about 31.87 billion and 40.41 billion yuan, respectively.

M1 has a high correlation with the stock market. The growth rate of M1 in January rose significantly to 5.9% (previous value 1.3%), and the gap between M1 and M2 growth rates narrowed significantly. Although this is influenced by last year's low base and seasonal factors, it also indicates that the economy is not as pessimistic as the market expected, which is related to the recent relaxation of real estate policies and the improvement of long-term loans for residential real estate sales.

As of the close, the Hang Seng Index in Hong Kong stocks rose by 0.84%. The Hang Seng Technology Index rose by 2.26%. Looking at the sectors, the consumer, technology, and financial sectors led the gains, with China Merchants Bank rising by more than 5%.Risk Warning:

The stock market involves risks, and investment should be approached with caution. This article does not constitute investment advice, and readers should think independently.