After 24 hours of intense trading, the Japanese yen has achieved its best monthly performance in over a year and a half. On Thursday, the yen surged past the 149 mark against the US dollar, reaching its highest level since March. However, the strengthening yen has significantly dragged down the domestic stock market. On Thursday, the Nikkei Stock Average in Japan recorded its largest intraday drop since 2020, while the central bank's interest rate hike weighed on real estate stocks.

The Bank of Japan unexpectedly raised interest rates on Wednesday, and the Federal Reserve hinted at the earliest rate cut starting in September. With the expected narrowing of the US-Japan interest rate differential, the market has refocused on the yen. Amundi and TD Securities predict that the yen-to-US dollar exchange rate may rise to 140.

The dual blow of the central bank's interest rate hike and the sharp increase in the yen led to the "largest drop in four years" in Japanese stocks, with all sectors declining. On Thursday, August 1st, the Nikkei Stock Average fell as much as 3.9%, marking the largest intraday drop since April 2020, with all sectors falling. Real estate stocks fell by 8.1%, and automobile stocks dropped by 6.4%. The department store sector, which had previously benefited from the yen's depreciation and a surge in tourism spending, lost steam.

The Nikkei 225 index fell as much as 3.5% during the session, and the decline narrowed to 2.5% by the close. The index had entered a technical correction last week.

"The Bank of Japan's interest rate hike has triggered two major concerns: one is that the yen's appreciation is a hindrance for exporters who have been benefiting from the yen's depreciation; the other is whether the economy can remain strong," said Tetsuo Seshimo, portfolio manager at Saison Asset Management Co. "There are still many unknowns."

As Japan intensifies its quarterly earnings announcements, corporate profits also put pressure on the stock market. Toyota, the most valuable company in Japan, contributed the most to the decline of the Nikkei Stock Average. Due to lower-than-expected operating profits in the second quarter, Toyota's share price fell by 8.5% at one point.

At the monetary policy press conference on Wednesday, Bank of Japan Governor Haruhiko Kuroda "hawkishly" stated that if the economy and inflation support it, the bank will continue to raise interest rates, and 0.5% is not a specific interest rate ceiling.

Tomoichiro Kubota, a senior market analyst at Matsui Securities, said, "Haruhiko Kuroda seemed like a different person at the press conference yesterday, with a hawkish attitude. The assumption that 'interest rates will not rise, and the yen will not appreciate' for the Japanese stock market has changed."The Japanese Yen Becomes the "Center of Attention" Again, with Majority Bullish to 140

Due to the significant shift by the Bank of Japan and the Federal Reserve, Wall Street has swiftly turned bullish on the Japanese Yen.

Analysts at Macquarie Group have stated, "The strong upward momentum of the yen is just beginning," with the US dollar to yen exchange rate potentially nearing 140 by the end of this year, and soaring all the way to 125 by December 2025. This would bring the yen to the US dollar exchange rate back to the levels seen at the beginning of 2022, when the Federal Reserve had just started raising interest rates.

"If the Federal Reserve begins an easing cycle, with heightened risk aversion and the Bank of Japan maintaining a firm tightening stance, the (yen to US dollar) exchange rate could rise to 140," said Paresh Upadhyaya, Head of US Fixed Income and Currency Strategy at Amundi, "Although this may seem like a formidable hurdle, it is not."

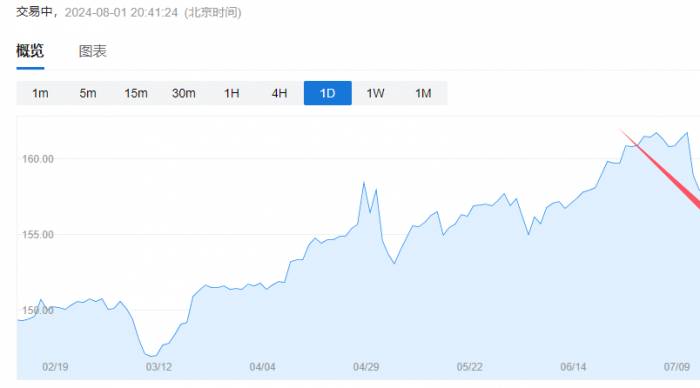

Following a nearly 2% surge on Wednesday, the yen appreciated by 1% against the US dollar on Thursday, reaching 148.51, with gains over the past month expanding to over 7%.

In the first half of this year, the US-Japan interest rate differential led to a 12% plummet in the yen, falling to its lowest point in 38 years at the beginning of July, making it the worst-performing currency in the G10 group, which forced Japan to intervene to support the yen in April and May.

Alex Loo, a macro strategist at TD Securities, said, "Japan's tightening of monetary policy will strengthen the feedback loop for the rebalancing of local assets," and he expects the yen to the US dollar exchange rate to rise to 140 in the first quarter of next year.

Christopher Wong, a foreign exchange strategist at Oversea-Chinese Banking Corporation, is also very optimistic, believing that a reasonable exchange rate for the yen to the US dollar is 136.

Charu Chanana, the head of foreign exchange strategy at Saxo Bank, believes that the yen has room to appreciate to below 145 this year, especially in the context of increased volatility and short covering.

Shusuke Yamada, the head of Japanese foreign exchange and rates strategy at Bank of America Securities in Tokyo, stated that with the Federal Reserve expected to cut interest rates, and the Bank of Japan projected to raise rates to 0.75% next year, this will drive the yen to trade in the vicinity of 140.Strategist Sebastian Boyd stated: "If the only pressure on the yen is the interest rate expectations between the United States and Japan, then the yen is still undervalued at present. There is more room for the yen to appreciate from the current level, with models indicating that the yen should be much stronger than it is now."

It is noteworthy that not everyone is bullish on the yen. Tohru Sasaki, Chief Strategist at Fukuoka Financial Group, warned that although the yen may rise in the short term, it could fall back to the 160 level again when the market's focus shifts back to interest rate differentials and economic fundamentals.

Sasaki said: "If the real interest rates remain significantly negative and do not turn positive, I believe it will be difficult for the yen to appreciate even in the medium to long term."