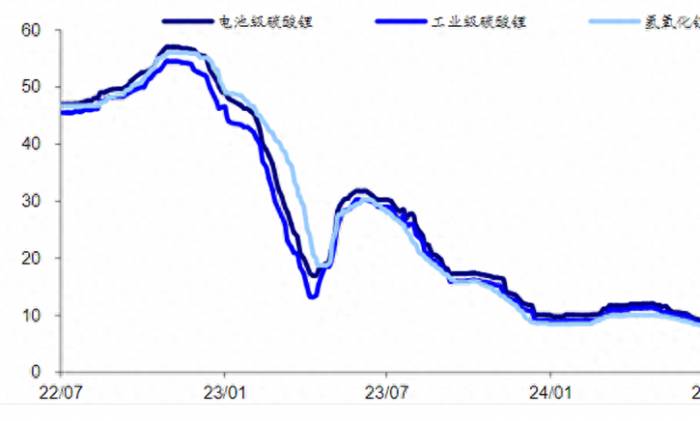

Lithium carbonate, which has fully entered a downward cycle, has once again seen a price drop of 10,000 yuan in one month, with the price now just a step away from breaking the 80,000 yuan/ton mark. With lithium prices continuously falling and breaking through the core cost lines of many lithium salt manufacturers, will only salt lake lithium extraction companies be able to make a profit in the future?

On July 31st, according to the latest data from Shanghai Steel Union, the average price of battery-grade lithium carbonate dropped to 80,500 yuan/ton, and the average price of battery-grade lithium hydroxide (coarse particles) dropped to 79,000 yuan/ton, both setting new lows for the year.

The downward trend in the current price of lithium carbonate is evident, and the futures price is equally pessimistic. The main futures contract price for lithium carbonate also reached a historical low of 80,700 yuan/ton since its listing on July 30th.

Wall Street See · See Wisdom Research believes that in the overall situation where the supply of lithium salts exceeds demand, it is hard to avoid the downward trend of lithium prices. However, with the arrival of the peak season for new energy vehicles in the second half of the year, lithium prices are expected to temporarily stop falling and re-experience the price rebound seen at the same period last year.

Furthermore, considering that the current contribution of lithium carbonate from domestic salt lakes is still less than 20%, and the growth in production capacity is limited, it is difficult for them to take a leading role in the supply of lithium carbonate in the medium term. Therefore, the future decline in lithium prices is also unlikely to continue based on the cost lines of salt lake lithium extraction companies.

1. Lithium salt manufacturers with their own mines also face the risk of losses, but salt lake factories still cannot dominate the market.

By the first half of this year, the three lines of defense for lithium carbonate prices—150,000 yuan/ton (cost line for purchasing lithium spodumene), 120,000 yuan/ton (cost line for owning lithium spodumene), and 90,000 yuan/ton (cost line for purchasing lithium concentrate) have been successively broken through.

This has directly led to most domestic lithium salt manufacturers experiencing a halving of profits or even a transition from profit to loss in the first half of the year. Among them, the manufacturers that barely maintained profitability are basically salt lake lithium extraction companies such as Salt Lake Co., Ltd. and Tibet Summit, as well as a few lithium salt manufacturers with a high rate of self-supplied lithium concentrate, such as China Mining Resources.

Now that the price of lithium carbonate has further dropped to 80,000 yuan/ton, this means that even lithium salt manufacturers with more lithium ore resources will begin to face the risk of losses (cost range of 60,000-80,000 yuan/ton). Only salt lake lithium extraction companies with the lowest cost lines (30,000-50,000 yuan/ton) are relatively safe and still have room for profit.

However, Wall Street See · See Wisdom Research believes that this does not mean that they will all be eliminated in the future. It is difficult for the domestic lithium salt market to be completely dominated by salt lake lithium extraction companies. In other words, lithium prices are also unlikely to continue to fall based on the cost lines of salt lake lithium extraction companies, otherwise, in the future, the supply from salt lakes alone will not be able to meet the terminal demand.The production of lithium from brine lakes is susceptible to seasonal fluctuations, unlike lithium concentrate, which can be supplied stably throughout the year. During the winter when temperatures are lower, the output of lithium extraction companies from brine lakes can significantly decrease due to production line maintenance and the freezing of brine. Therefore, domestically, lithium concentrate remains the primary source of raw material for lithium carbonate. Specifically, in the first half of this year, the total domestic production of lithium carbonate was 298,000 tons, with lithium concentrate, lithium mica, and brine lakes accounting for 44%, 27%, and 19% of the lithium carbonate output, respectively. The raw material source for the 108,000 tons of imported lithium carbonate is also primarily lithium concentrate.

Although some lithium extraction companies are nearing the break-even point, they have to continue operating their established production lines to maintain market share. At the same time, these companies' balance sheets remain relatively robust, and even if they struggle to make a profit in the short term, they will choose to persist in their operations.

The strategy of large manufacturers to continue operations is to force smaller and medium-sized manufacturers with higher costs to exit the market first, thereby achieving capacity clearance. This situation also occurred in the last cycle of lithium prices, where the shutdown of small and medium-sized lithium salt plants and the elimination of high-cost capacity effectively alleviated the oversupply pressure in the market.

However, if lithium prices further decline to the cost range of brine lake lithium extraction (30,000-50,000 yuan/ton), even large manufacturers will face severe operational challenges, and such extreme conditions may trigger a broader industry reorganization.

Due to the slow capacity expansion of domestic brine lake lithium extraction companies, even the leading company, Salt Lake Co., has a target sales volume of only about 40,000 tons of lithium carbonate this year, and the sales volumes of other smaller brine lake lithium extraction companies such as Tibet Summit and Tibet Mining are only around 10,000 tons. Therefore, in the short to medium term, the supply of lithium from brine lakes still cannot play a dominant role. It is also worth noting that the nearly 20% contribution of lithium carbonate from brine lakes is the result of a significant decline in the start-up rate of lithium salt manufacturers using lithium concentrate and lithium mica as raw materials after the cost inversion following the continuous decline in lithium carbonate prices this year (the start-up rates of lithium concentrate and lithium mica manufacturers were 55% and 30%, respectively, in the first half of the year).

2. Lithium prices are expected to stop falling and rebound in the second half of the year during the car market peak season.

The continuous decline in lithium prices has caused market concerns, but on the positive side, since the second quarter of this year, sales at the lithium ore end have improved first, and the prosperity has slightly rebounded. According to the second quarter financial report released by Australian IGO company on July 30, the production of lithium concentrate at its Greenbushes mine was 332,000 tons in the second quarter, with sales reaching 530,000 tons, setting a new high in nearly two years and ending the situation of inventory accumulation where sales were lower than production for a year.

With the arrival of the peak season for the new energy vehicle market in the second half of the year, power battery manufacturers and cathode material manufacturers will also stock up in advance to cope with the increase in terminal sales. Under the growth of demand, lithium carbonate prices are also expected to stop falling and rebound. At the end of the second quarter of this year, downstream inventory has increased significantly. Taking the leading company CATL as an example, by the end of the second quarter, CATL's raw material inventory level reached 6.83 billion yuan, a 45% increase from the beginning of the year. With the continuous growth of battery product shipments, raw material inventory has also grown synchronously, indicating that CATL has also started an active restocking rhythm.

Interestingly, last year's lithium carbonate prices also rebounded in the second half of the year, first falling from 450,000 yuan/ton at the beginning of the year to about 150,000 yuan/ton in the middle of the year, and then slowly warming up from July to a maximum of 320,000 yuan/ton.

3. Lithium salt manufacturers are also starting a self-help mode, with limited effects.Facing the unfavorable trend of lithium prices continuously breaking through the cost line, lithium salt manufacturers have actually taken quite a few measures to maintain the stability of lithium prices, including reducing or suspending production to appropriately lower output (in July, 7 lithium salt manufacturers, including Jinhui Lithium Industry and Tianzhuo New Materials, chose to reduce or suspend production, reducing output by 1,400 tons, accounting for 3% of the monthly level). However, most manufacturers did not participate, so the proportion of reduced production is not significant, and the overall effect is also not good.

In addition, since the second quarter of this year, lithium salt manufacturers such as Ganfeng Lithium, Rongjie Shares, and Shengxin Lithium Energy have also officially started hedging work for lithium carbonate commodity futures, using financial derivatives to hedge the risk of falling lithium prices. This move has had some effect. Taking Shengxin Lithium Energy, which started hedging work the earliest, as an example, despite the continuous decline in lithium salt prices, Shengxin Lithium Energy's net loss in the second quarter has significantly narrowed, from -144 million yuan in the first quarter to a maximum of -46 million yuan in the second quarter.

In summary, the lithium price breaking 8 indeed poses a severe challenge to lithium salt manufacturers, and currently only salt lake manufacturers can stand on their own and maintain a certain profit. It is hoped that in the second half of the year's car market peak season, the lithium price can stop falling and rebound as it did last year.