Data from the Federal Reserve Bank of New York in August showed that the one-year and five-year inflation expectations remained stable at 3% and 2.8%, respectively. The three-year inflation expectation edged up slightly from 2.3% in July to 2.5%. Meanwhile, the employment trends index in August climbed slightly from the revised 108.71 to 109.04.

The market is closely watching the U.S. presidential debate on Tuesday, as well as the release of U.S. CPI data on Wednesday and PPI data on Thursday. The CPI data, in particular, may have a significant impact on the decision to cut interest rates before the FOMC meeting, as although the market widely expects a 25 basis point rate cut, the specific magnitude of the rate cut has not yet been determined.

After a significant sell-off last week, the market bought U.S. stocks on the dip, with all three major indices rising by more than 1.1%. All sectors except for communication services were up, with the industrial and non-essential consumer sectors leading the gains, boosted by a 3.36% rise in Boeing and a 2.63% rise in Tesla. The U.S. dollar strengthened, and short-term U.S. Treasury yields fell. Treasury auctions for 3-year, 10-year, and 30-year bonds will be held later this week, with longer-term bonds expected to attract more buyers. Oil prices rose due to market concerns that a tropical storm could disrupt production and refining along the U.S. Gulf Coast.

All three major U.S. stock indices rebounded by more than 1%, with technology stocks performing exceptionally well. Nvidia closed up 3.54%, Apple, which fell as much as 1.8% during its product launch event, ended the day up 0.04%, and Nio surged nearly 11%, marking five consecutive days of gains to a four-month high.

All three major U.S. stock indices rose: The S&P 500 index closed up 62.63 points, a gain of 1.16%, at 5,471.05. The Dow Jones, closely related to the economic cycle, closed up 484.18 points, a gain of 1.20%, at 40,829.59. The tech-heavy Nasdaq Composite closed up 193.77 points, a gain of 1.16%, at 16,884.60. The Nasdaq 100 closed up 1.3%. The NASDAQ Technology-Weighted Index (NDXTMC), which measures the performance of technology stocks in the Nasdaq 100, closed up 1.11%. The Russell 2000 index, more sensitive to the economic cycle, closed up 0.30%. The VIX, a measure of market volatility, closed down 13.09%, at 19.45.

U.S. industry ETFs rose across the board. The Global Airlines ETF closed up 2.64%, the Semiconductor ETF rose 2.26%, and the Technology Sector ETF, Global Technology Stock Index ETF, Financial Industry ETF, Consumer Discretionary ETF, Biotechnology Index ETF, and Utilities ETF all rose by at least 1%, with the Banking Industry ETF up 0.65%, the worst performer.

All 11 sectors of the S&P 500 index closed higher. The S&P Consumer Discretionary sector rose 1.63%, with the Industrial, Information Technology/Technology, Financial, and Real Estate sectors all rising by at least 1.15%. The Energy sector rose 0.77%, and the Telecommunications sector rose 0.04%, the worst performer.

In terms of news, analysts at HSBC said that given labor market data indicating the economy is cooling rather than on the brink of recession, and the resilient third-quarter corporate earnings outlook, they are more bullish on U.S. stocks. However, analysts at Citibank hold a different view, believing that the significant liquidation of long positions in the S&P 500, coupled with an increase in short positions in the Nasdaq 100, indicates a shift in risk appetite towards a more direct bearish inclination. Strategists at RBC Capital Markets said that due to risks brought by seasonal factors, market sentiment, and the presidential election, there is room for further declines in the U.S. stock market. If concerns about a hard landing escalate, the risk of a growth panic causing stock market declines in the 14%-20% range will also certainly increase.

Among the "Tech Seven Sisters," only Google A fell. Nvidia closed up 3.54%, Tesla closed up 2.63%, Amazon closed up 2.34%, Microsoft closed up 1%, and Meta closed up 0.9%. Apple edged up 0.04%, with its stock price falling to an intraday low during its iPhone 16 launch event, then rebounding.

Apple's stock price fell to an intraday low during the iPhone 16 launch event, then rebounded.Chip stocks experienced more gains than losses. The Philadelphia Semiconductor Index closed up by 2.15%. The industry ETF SOXX closed up by 1.98%; NVIDIA's double long ETF closed up by 6.95%. Arm Holdings closed up by 7.03%, and Marvell Technology closed up by 4.12%. TSMC's U.S. shares closed up by 3.8%, with reports indicating that Samsung is collaborating with TSMC to develop HBM4. NVIDIA closed up by 3.54%, AMD closed up by 2.83%, Broadcom closed up by 2.79%, ON Semiconductor closed up by 2.16%, Qualcomm closed up by 1.63%, and KLA closed up by 1.01%. Intel closed up by 0.95%, with reports suggesting that Intel will fully delegate processes below 3 nanometers to TSMC and plans to lay off 15% of its global workforce. Micron Technology closed down by 0.13%, and ASML closed down by 0.39%.

Most AI concept stocks rose. Palantir closed up by 14.08%, marking the largest single-day gain since February, following the company's inclusion in the S&P 500 Index. BigBear.ai closed up by 10.85%, Dell's U.S. shares closed up by 3.81%, as the company will join the S&P 500 Index. SoundHound AI, an AI voice company with NVIDIA's stake, closed up by 6.21%, Super Micro Computer closed up by 6.06%, Snowflake closed up by 1.29%, BullFrog AI closed up by 1.24%, C3.ai closed up by 0.42%, CrowdStrike remained flat, while Oracle closed down by 1.35%, with after-hours earnings showing that cloud business drove profits beyond expectations, leading to a post-market surge of over 9%.

Palantir and Dell will be included in the S&P 500 Index, and both rose on Monday.

Chinese concept indices rose in unison. The NASDAQ Golden Dragon China Index closed up by 0.69%. Among ETFs, the China Technology Index ETF (CQQQ) closed up by 0.26%. The China Internet Index ETF (KWEB) closed up by 0.36%.

Among popular Chinese concept stocks, NIO closed up by 10.96%, Zeekr closed up by 3.66%, Li Auto closed up by 3.06%, Vipinhui closed up by 2.08%, Meituan ADR closed up by 1.4%, New Oriental closed up by 1.11%, Baidu closed up by 0.77%, Tencent Holdings ADR closed up by 0.68%, Alibaba closed up by 0.32%, while NetEase closed down by 0.03%, Bilibili closed down by 0.07%, XPeng closed down by 0.23%, Ctrip.com closed down by 0.63%, JD.com closed down by 0.69%, Pinduoduo closed down by 0.9%, and Mengniu Dairy ADR closed down by 0.93%.

Among other key individual stocks: (1) Boeing's U.S. shares closed up by 3.36%, as it reached a preliminary labor agreement with the union, averting the threat of a costly strike. (2) Eli Lilly's U.S. shares closed up by 0.62%, with the appointment of a new Chief Financial Officer. (3) HSBC's U.S. shares closed up by 2.03%, with reports that HSBC is considering merging its commercial and investment banks to reduce costs. (4) Applied Digital, a cryptocurrency concept stock invested in by NVIDIA, surged by over 40%.

European stock markets rebounded, with the pan-European Stoxx 600 Index ending a five-day losing streak:

The pan-European Stoxx 600 Index rose by more than 1% during the session, eventually closing up by 0.82% at 510.70 points, with tourism and leisure stocks leading the way up by 2.18%, and bank stocks up by 1.17%. Among the constituents, Kering Group's European shares fell by 4.3% at one point during the session, marking the largest drop in about seven weeks, and eventually closed down by 2.52%, as Barclays analysts downgraded the stock rating from Equal Weight to Underweight.

The German stock index closed up by 0.77%. The French stock index closed up by 0.99%. The Italian stock index closed up by 0.90%. The Spanish stock index closed up by 0.89%. The UK stock index closed up by 1.09%. The Dutch AEX Index closed up by 1.03%.

On the "day after the non-farm", the two-year U.S. Treasury yield rose by more than 2 basis points, and the 2/10-year U.S. Treasury yield curve ended its inversion for two consecutive days, with short-term bond yields moving away from their 18-month low and base bond yields hovering near their lowest in over a year.US Treasury Bonds: At the end of the day, the two-year US Treasury yield, which is more sensitive to monetary policy, rose by 2.67 basis points to 3.6729%, trading within the range of 3.6522%-3.7081%. The US 10-year benchmark Treasury yield fell by 0.57 basis points to 3.7023%, reaching a daily high of 3.7607% at 16:50 Beijing time, then fluctuated downwards, and subsequently hit a daily low of 3.6892% at 01:21.

Eurozone Debt: The benchmark 10-year German bund yield fell by 0.4 basis points. The two-year German bund yield fell by 1.6 basis points. The French 10-year government bond yield rose by 0.3 basis points, while the Italian 10-year government bond yield fell by 0.4 basis points.

Although the stock market rebounded somewhat, the bond market remained relatively calm, with the 10-year US Treasury yield failing to rebound, gradually falling throughout the day after rising in the morning, and closing lower.

Expectations for a significant rate cut by the Federal Reserve receded, with the US dollar index rising by more than 0.4%, continuing the rebound from the non-farm payrolls day. The Japanese yen fell more than 1% against the US dollar at one point, ending its four-day winning streak and moving away from its yearly high. The offshore renminbi fell by 300 points at one point, with the market expecting a 25 basis point rate cut by the European Central Bank on Thursday, sending the euro to a three-week low:

Dollar: The US dollar index (DXY), which measures the value against a basket of six major currencies, rose by 0.44% to 101.627 points, trading within the range of 101.144-101.696 points, continuing the rebound from the non-farm payrolls day; on August 27, it had fallen to 100.514 points.

Bloomberg Dollar Index: The Bloomberg Dollar Index rose by 0.27% to 1235.13 points, trading within the range of 1231.06-1236.45 points.

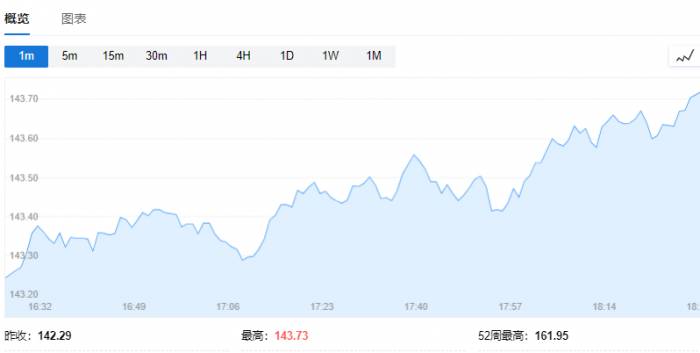

Yen: The Japanese yen fell by 0.60% against the US dollar, trading at 143.16 yen, with a trading range of 141.96-143.80 yen. A former high-ranking official from Japan's Financial Services Agency stated that market turmoil has subsided, and the Bank of Japan may still raise interest rates before the end of the year.

Offshore Renminbi: The offshore renminbi (CNH) fell by 254 points against the US dollar at the end of the day, trading at 7.1202 yuan, with overall trading within the range of 7.0845-7.1254 yuan.

Most cryptocurrencies headed higher. The largest by market capitalization, Bitcoin, rose by 6.65% at the end of the day, trading at $57,265.00, within a range of $54,545.00-$57,480.00. The second-largest, Ethereum, rose by 8.21% at the end of the day, trading at $2,352.00, within a range of $2,282.00-$2,364.50.Due to the intensification of Tropical Storm "Francine," oil drilling companies have partially suspended production. After falling to the lowest in over a year, US oil rebounded by more than 1.5%, and Brent oil, after dropping to the lowest in nearly three years, rebounded by over 1.1%. Dutch natural gas futures initially surged by more than 111% in the early European market session:

US Oil: WTI October crude oil futures closed up $1.04, a gain of over 1.53%, at $68.71 a barrel. During the US stock market's morning session, US oil reversed its earlier upward trend, falling by more than 0.5% to approach the $67 mark, then continued to rise, hitting a daily high during the US stock market's midday session with a gain of over 1.9%, approaching the $69 mark.

Brent Oil: Brent November crude oil futures closed up $0.78, an increase of about 1.10%, at $71.84 a barrel. During the European stock market's morning session, Brent oil continued its earlier upward momentum, rising by more than 1.6% and breaking through the $72 mark, then continued to decline, hitting a daily low during the US stock market's morning session with a drop of nearly 0.6%, approaching $70.60, before rebounding to turn positive.

Wall Street's perspective: Daan Struyven, head of oil research at Goldman Sachs, stated that since the beginning of July, financial demand for oil has decreased by 400 million barrels, equivalent to a daily reduction of 7 million barrels. Goldman Sachs estimates that the probability of the US entering a recession in the next 12 months is 20%, thus considering a recession unlikely. OPEC+ is expected to increase production in December, and the Brent oil price is expected to fluctuate between $70 and $85 per barrel.

In terms of news, the intensifying Tropical Storm "Francine" moving north in the Gulf of Mexico has prompted oil drilling companies to evacuate workers and suspend some offshore crude oil production. "Francine" is expected to hit parts of the Gulf Coast with strong winds and heavy rain and is forecasted to make landfall as a full-fledged hurricane on Wednesday. According to Bloomberg's calculations based on data from the US Bureau of Ocean Energy Management and the National Hurricane Center, the daily production of oil fields intersecting the storm's projected path is approximately 125,000 barrels of crude oil and 300 million cubic feet of natural gas.

Natural Gas: US October natural gas futures closed down by more than 4.61%, at $2.17 per million British thermal units. The European benchmark TTF Dutch natural gas futures rose by 2.50%, at €37.260 per megawatt-hour. ICE UK natural gas futures rose by 2.19%, at 89.750 pence per therm.

Expectations of a rate cut by the Federal Reserve next week supported a slight rise in gold prices, with spot gold hovering near the $2500 mark:

Gold: COMEX December gold futures closed up 0.43%, at $2535.50 per ounce. Spot gold reversed its earlier upward trend before the European stock market session, falling by nearly 0.5% and breaking below $2490, then continued to rise, hitting a high of nearly 0.4% above the $2500 mark after the US stock market's midday session. At the close, spot gold was up 0.36%, at $2506.38 per ounce, after setting a historical high of $2531.60 on August 20.

Silver: COMEX December silver futures closed up 1.59%, at $28.690 per ounce. After the Asian stock market's midday session, spot silver reversed its earlier upward trend, falling by nearly 0.8% and approaching $27.70, then continued to rise, with the US stock market's midday session seeing a gain of over 1.6% and breaking above $28.30. At the close, spot silver was up 1.47%, at $28.3459 per ounce.

The market has currently accepted the possibility of a 25 basis point rate cut by the Federal Reserve in September and has turned its attention to the CPI and PPI data to be released this Wednesday and Thursday. Kinesis Money analyst De Casa stated that if inflation data is significantly lower than expected, expectations for a 50 basis point rate cut could surge, and gold prices may hit a historical high. However, even if the market generally anticipates a 25 basis point rate cut, gold prices are not expected to fall significantly, as the Federal Reserve will definitely cut rates.Most base metals in London's industry rose. The economic indicator "Dr. Copper" increased by more than 1.12%, reporting at $9,097 per ton. London zinc closed up by $14. London nickel closed up by $10. London aluminum closed up by $8. London lead fell by $10. London tin fell by more than 0.66%.

COMEX copper futures increased by 1.64%, reporting at $4.1405 per pound. The price of iron ore broke below $90 per ton during the trading session, the first time since November 2022.

Gold prices remained stable but were still slightly below the historical high.

The following content was updated before 23:00 on September 9th:

US stocks warmed up, with the technology and communication services sectors rising by more than 1%, leading the gains:

All three major US stock indices rose: The S&P 500 index once increased by more than 1.1%. The Dow Jones, closely related to the economic cycle, once increased by more than 1.1%. The technology-heavy Nasdaq once rose by nearly 1.4%.

At the beginning of the US stock market, most major industry ETFs rose, with semiconductor ETFs, technology industry ETFs, and global technology stock index ETFs leading the gains.

Most of the "Tech Seven Sisters" rose. Nvidia once increased by more than 3.6%, Tesla once increased by more than 4.3%, Amazon once increased by more than 2.3%, Meta once increased by more than 2.2%, Microsoft increased by more than 1.7% and then halved its gains, while Google A increased by nearly 1.8% and then fell by more than 0.1%, and Apple once fell by nearly 1.4%.

Most chip stocks rebounded. The Philadelphia Semiconductor Index once increased by nearly 2.4%; Arm Holdings once increased by more than 5.2%, TSMC's US stocks once increased by more than 4%, Intel once increased by more than 3.3%, Marvell Technology once increased by more than 3.4%, and ON Semiconductor once increased by more than 3.4%, while Micron Technology once fell by more than 1%.

Most AI concept stocks rose. Palantir once increased by more than 12%, BigBear.ai once increased by more than 6.1%, Nvidia's AI voice company SoundHound AI once increased by more than 5.6%, Dell Technologies once increased by more than 5.5%, Serve Robotics once increased by more than 5.6%, while Oracle once fell by more than 0.4%.Chinese concept stocks experienced mixed movements. After falling by more than 0.6%, the NASDAQ Golden Dragon China Index rebounded by nearly 0.2%, but is now turning downward. Among popular Chinese concept stocks, Pinduoduo once fell by over 3.3%, XPeng Motors once fell by over 5.1%, Bilibili once fell by over 2.2%, while NIO once rose by over 5.2%, Zeekr once rose by over 4%, Vipin once rose by over 2.4%, Meituan ADR once rose by over 1%.

Other key individual stocks include: (1) Boeing's U.S. stocks once rose by nearly 4.6% due to a preliminary labor agreement with the union. (2) HSBC's U.S. stocks once rose by over 2.3%, with news that HSBC is considering merging its commercial and investment banks to reduce costs.

The following content was updated before 21:50 Beijing time:

Last Friday's non-farm data was below expectations, once again raising market concerns about a U.S. economic recession, which dragged down U.S. stocks. Both Japanese and South Korean stocks opened lower, with the Nikkei 225 index once falling by 3%, but the declines were subsequently narrowed.

With expectations of a significant interest rate cut by the Federal Reserve in September heating up, European and American stock markets rebounded significantly, with most star technology stocks rising, and Tesla's stock price increased by more than 2%.

In the early U.S. stock market, the three major stock indices rose collectively, with Tesla's stock price increasing by more than 2%;

The stock indices of many European countries such as France and the Netherlands rose by 1%, and the Stoxx Europe 600 index rose by 0.7%.

The declines in Japanese and South Korean stocks were narrowed, with the Nikkei 225 index closing down by 0.5%, after once falling by 3%. The South Korean Seoul Composite Index closed down by 0.3%, after once falling by 2%.

Iron ore prices broke below the $90 mark in the morning. The price of iron ore broke below $90 per ton for the first time since November 2022.

The U.S. dollar's intraday gain against the Japanese yen expanded to 1%. The U.S. Dollar Index continued to rise throughout the day, currently up 0.38% to 101.57.【21:35 Update】

U.S. stocks rose across the board in the early trading session, with the Nasdaq up 1.12%, the S&P 500 up 0.87%, and the Dow Jones up 0.49%;

Apple's product launch event is entering the countdown, dipping by 0.14%;

Tesla's stock rose by over 2%; NVIDIA's stock rose by over 2%; Dell's stock surged by more than 5%, as the company is set to join the S&P 500 Index;

Boeing's stock rose by over 2%, following the preliminary labor agreement reached with the union;

Alibaba's stock fell by 0.38% at the start of trading, as the company's shares were officially included in the Hong Kong Stock Connect, effective from September 10th.

HSBC Holdings' stock rose by over 2%, following news that HSBC is considering merging its commercial and investment banking arms to reduce costs.

【19:35 Update】

Alibaba's pre-market stock gain in the U.S. once expanded to 0.5%, as the company's shares were officially included in the Hong Kong Stock Connect, effective from September 10, 2024.

European stocks continued to rise, with the pan-European Stoxx 600 up 0.7%, the French CAC 40 up 1%, the Dutch AEX up 1%, the Italian FTSE MIB up 1.18%, the German DAX up 0.8%, and the UK's FTSE 100 up 0.7%.【18:35 Update】

Nasdaq futures increased to more than 1% at one point.

The US dollar rose 1% against the Japanese yen. The US dollar index rose 0.50% during the day, currently at 101.70.

【16:30 Update】

The British pound fell 0.3% against the US dollar, reporting at 1.3086, the lowest since August 23. The US dollar index continued to rise during the day, currently up 0.38% at 101.57.

【16:10 Update】

Nasdaq futures rose 0.8% during the day, S&P 500 futures rose 0.6%, and Dow futures increased by more than 0.4%.

Tesla and TSMC both rose over 2%, NVIDIA rose 1.6%, and Apple rose 0.68%. Boeing's US pre-market stock rose 3.1% due to a preliminary labor agreement with the union.

Dell's US pre-market stock rose 6%, as the company will join the S&P 500 index.

【15:10 Update】European major stock indices opened slightly higher, with the Euro Stoxx 50 index up by 0.55%, the German DAX index up by 0.57%, the UK's FTSE 100 index up by 0.63%, and the French CAC 40 index up by 0.37%.

【Update as of 12:10】

As of press time, the Nikkei 225 index fell by 1.84%, with Renesas Electronics and Tokyo Electron falling over 6%, and Toyota Motor falling over 4%. The South Korean KOSPI index narrowed its decline to 0.7%, with Samsung Electronics falling by 2.3%.

The Japanese yen's exchange rate against the US dollar saw a slight increase in its decline.

【8:25 Update】

As of press time, the Nikkei 225 index's decline expanded to 3%. Toyota Motor and Mitsubishi UFJ Financial Group fell over 4%. The Australian stock index S&P/ASX fell to 1.2%. The MSCI Asia-Pacific index's decline expanded to 1%.

Affected by the technology sector's nearly 3% drop, the South Korean KOSPI index fell over 2% during the session, reaching its lowest level since August 5th. Samsung Electronics' stock price once fell by 3.3%, reaching its lowest since October 10th of last year, with SK Hynix and LG Energy Solution also heading downward.

Iron ore prices broke below $90 per ton for the first time since November 2022.

The Japanese yen slightly depreciated against the US dollar, following the revision of Japan's second-quarter real GDP annualized quarter-on-quarter final value.

According to a Bloomberg report, Shoji Hirakawa, the chief global strategist at Tokai Tokyo Research Institute, stated: "Global investors may be averting risk and cashing out." He believes that investors may have decided that, given the non-farm employment report was below expectations, concerns about the US economy and the possibility of significant interest rate cuts cannot be ignored.