No one could have anticipated that after the great bear market of 2023, the A-share market would experience such a devastating decline in the first month of 2024. This January will go down in the annals of the A-share market, and we may look back on it with curiosity in the future. By the end of January, the ChiNext Index had plummeted by 16.81%, erasing the losses of the previous year, the small-cap index CSI 1000 fell nearly 20%, the average A-share stock price dropped by over 20% in a month, and even the 2015 stock market crash wasn't this exaggerated, comparable to the 2016 circuit breaker.

However, in stark contrast to the A-share market disaster, the bond market has seen a bull market. Recently, the yield on China's ten-year government bonds has fallen below 2.5%, reaching a new low since 2002. On one hand, last week the central bank cut interest rates in a targeted manner to stabilize the market, and the market still expects further rate cuts from the central bank; on the other hand, the poor performance of the capital market has highlighted the seesaw effect between stocks and bonds, with funds seeking refuge in the bond market.

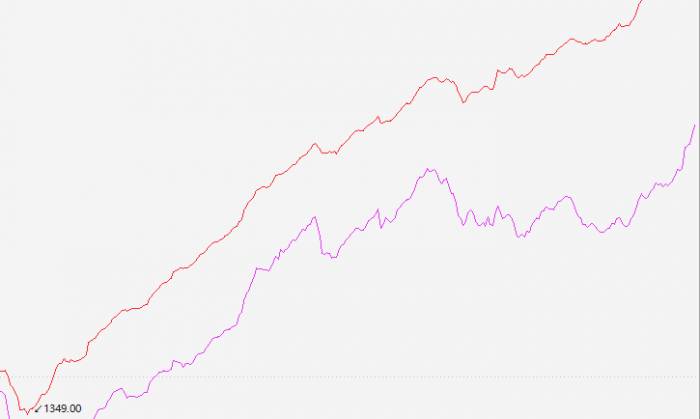

The chart below shows the long-term pure bond fund index and the short-term pure bond fund index. It can be seen that since last October, both bond fund indices have entered a bull market. The long-term pure bond fund index rose by 1.77% last year, and the short-term pure bond fund index increased by 2.71%. Although the gains are not as high, they are a stable happiness relative to the stock market, and they have continued to achieve positive returns this year.

However, we should not completely dismiss the A-share market. Although the rapid short-term decline is panic-inducing, rationally speaking, opportunities are created by declines, and the lower the current position, the greater the potential for future increases. The A-share market has now reached a critical stage of clearing out positions, and the rebound from the oversold condition after clearing may recover most of the January losses. What retail investors need to do is to hold on and endure the final battle.

In the long term, the A-share market is likely to move from a bear market to a bull market, but the premise of talking about the long term is to survive. For ordinary investors, seeking refuge in bond funds now may be a better way to help themselves get through.

Firstly, it is highly probable that the central bank will continue to cut interest rates after the holiday, and there is still room for the bond market to rise. During the long Spring Festival holiday, there are many uncertainties, and hiding in bond funds can both hedge the stock market's volatility and avoid the risks of the overseas market during the Spring Festival. It can also secure stable returns. After the stock market risks are cleared and sentiment picks up, one can then switch to stock funds at the right time, as it is quite convenient to transfer between them on Alipay.

If you are a Wealth Black Card user on Alipay, you can now enjoy a 10% discount on the purchase of bond funds, as well as the most valuable 180,000 yuan of considerate benefits. For example, if you buy a 100,000 yuan monthly positive return bond fund, the fee rate is originally 0.3%, but with a 10% discount, it becomes 0.03%, saving 290 yuan immediately, which is equivalent to saving a New Year's Eve dinner. If you are not yet a Black Card user, search for the Wealth Black Card on Alipay, and by purchasing bond funds, you can enjoy stable returns and become a Black Card user, enjoying the associated rights and benefits.

From the perspective of returns, the bond market is likely to continue its bull run, and securing a month of stable returns can both hedge the significant fluctuations in the stock market and facilitate finding opportunities when the stock market recovers.

From a longer-term perspective, constructing an investment portfolio with stocks or stock funds and bond funds, increasing the position of stock funds when the stock market has a high cost-performance ratio, and reducing the stock position and increasing the bond fund position when the stock market shows signs of a bubble, can help us lock in profits and avoid giving back all the gains due to excessive enthusiasm. This can effectively reduce the volatility of the investment portfolio, which is the way to long-term success for ordinary investors.For investors with a higher risk appetite who seek greater returns but do not wish to suffer in the A-share market, gold ETFs connected to funds might be a good choice.

It can be observed that the international gold price has been on an upward trend since the beginning of 2023. COMEX gold has risen from its lowest point in November 2022 at $1,618 per ounce to the current $2,063 per ounce.

Benefiting from the sustained strength in international gold prices, gold ETFs have also entered a bull market, with an increase of over 16% in 2023, significantly outperforming bond funds, not to mention A-shares, which have also achieved positive returns from the beginning of 2024.

There are three main reasons behind the gold bull market:

Firstly, gold is priced in US dollars. In the long term, the continuous rise in gold prices is backed by the continuous devaluation of credit currencies. The US's Modern Monetary Theory (MMT) has led to the long-term over-issuance of currency, causing credit currencies to devalue, and naturally, gold will continue to appreciate. In the short term, expectations of interest rate cuts by the Federal Reserve will also drive up gold prices.

Secondly, due to the dollar hegemony and the US's misuse of sanctions, central banks around the world are accelerating the diversification of their foreign exchange reserves, especially increasing their reserves of gold. According to reports, the demand for gold purchases worldwide has remained strong in 2023, with central banks actively increasing their gold reserves and plans for further increases. China's gold reserves have been increasing month by month since November 2022, with a total increase of 9.23 million ounces.

Thirdly, gold also has a safe-haven function. From the Russia-Ukraine conflict to the Israel-Palestine conflict, geopolitical conflicts around the world have intensified, and overseas markets tend to be more volatile during the long holidays of A-shares. Allocating gold can provide a good risk hedge.

For ordinary people, buying physical gold has a high threshold and is inconvenient. Gold ETF funds are the lowest threshold way to invest in gold, with as little as 10 yuan allowing investment in physical gold. The gold ETFs purchased correspond to real gold stored in the vaults of the Shanghai Gold Exchange and can be redeemed at any time. Therefore, gold ETFs are the best choice for investing in gold.Overall, whether for beginners in personal finance or for seasoned stock market veterans who have been deeply hurt by the A-share market, Alipay's bond funds and gold ETF linked funds are both good choices. Becoming a Black Card user allows one to enjoy quite favorable benefits.