There is substantial evidence that the U.S. labor market is cooling down, and it is almost certain that the Federal Reserve will cut interest rates in September, although the magnitude and speed of the rate cut are still a matter of debate.

For bond traders, the magnitude and speed of the rate cut is a thorny issue. Traders who have previously misjudged the Federal Reserve's pace of rate hikes have found that predicting rate cuts is equally troublesome.

The current market is deeply divided in its views. On one hand, some believe that the rate cut trade has already been front-run, with U.S. Treasury yields having fallen significantly, already pricing in and digesting the Federal Reserve's future rate cuts. On the other hand, some argue that the Federal Reserve's rate cuts may be more aggressive than the market expects, and there is still room for U.S. Treasuries to rise. However, there is a consensus that the subsequent trend of U.S. Treasuries may depend on the pace of the Federal Reserve's rate cuts.

Is U.S. Treasury front-running? The subsequent trend of U.S. Treasuries may depend on the pace of the Federal Reserve's rate cuts.

As the Federal Reserve's meeting on September 18 approaches, the market widely expects the Fed to cut rates for the first time since 2020, an expectation that has previously driven a significant rise in U.S. Treasuries.

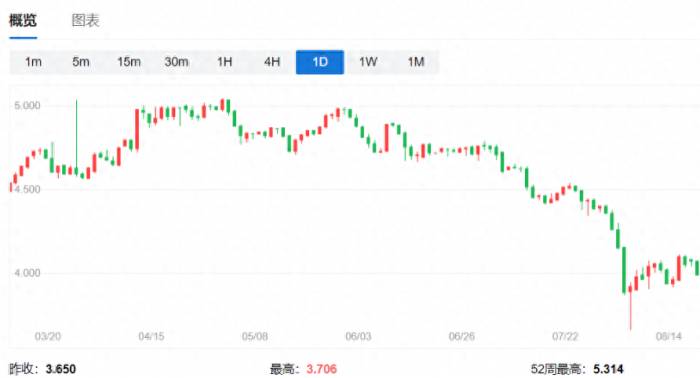

Currently, the policy-sensitive U.S. 2-year Treasury yield has fallen from over 5% in April to around 3.7%, and the 10-year Treasury yield has also dropped from over 4.5% in April to the 3.7% level. The robust rise in U.S. Treasuries has already reflected the market's pricing of future Federal Reserve rate cuts. Lower borrowing costs have also promoted the rise of corporate bonds and stocks, easing the pressure on financial markets.

Some investors believe that U.S. Treasuries have significantly front-run the market.

John Madziyire, a senior investment manager at Vanguard, which manages $9.7 trillion in assets, said that everyone knows the Federal Reserve needs to cut rates, but the key is the speed. If the rate cut is too fast, it could lead to a re-acceleration of inflation. He believes that the current bond market rally is too fast and has taken a "tactical short-term bearish" stance.

Saira Malik, Chief Investment Officer at Nuveen, also said that the market may be too optimistic about the speed of the Federal Reserve's rate cuts, and she believes that the 10-year Treasury yield may rise from the current 3.7% to around 4%. Bob Michele from J.P. Morgan Asset Management also believes that the bond market has gotten ahead of the Federal Reserve's actions. Although the economy is slowing down, it has not deteriorated, and he prefers to invest in higher-yielding corporate bonds rather than Treasuries.

However, Jamie Patton from TCW Group holds a completely opposite view. Patton believes that the market's expectations are not sufficient, and there may still be room for short-term U.S. Treasuries to rise. She said, "The Federal Reserve will have to lower interest rates at a faster and more aggressive pace than the market expects."BlackRock's Senior Portfolio Manager Jeffrey Rosenberg also issued a warning that the Federal Reserve's interest rate cut may exceed expectations. He said that if there is a 50 basis point rate cut in September, it could signal (concerns about the economy), which could trigger significant market turmoil.

A Bloomberg article reported that despite the market's high expectations for a Federal Reserve rate cut, the market has been proven wrong on several occasions. Traders have underestimated the magnitude of the Federal Reserve's rate hikes and then prematurely bet on a policy reversal, resulting in new losses. The post-pandemic economic performance has exceeded expectations, causing repeated misses in forecasts by the Federal Reserve and Wall Street.

The U.S. Treasury market still carries risks, but the consensus among many analysts is that the trend of U.S. Treasuries is related to the pace and magnitude of subsequent rate cuts by the Federal Reserve.

What is the pace of the Federal Reserve's rate cuts?

Regarding the magnitude of the rate cut in September, Goldman Sachs commented in a research report that the Federal Reserve leadership believes a 25 basis point rate cut in September is the baseline scenario.

In our view, these remarks are consistent with our expectation that the Federal Reserve will cut rates by 25 basis points in September, but if the labor market continues to deteriorate, the Federal Reserve leadership is willing to cut rates by 50 basis points at subsequent meetings.

According to a Wall Street Journal report, Peter Cardillo, Chief Market Economist at Spartan Capital Securities, said, "The fact that (in August) more than 100,000 non-farm jobs were added weakened the possibility of the Federal Reserve cutting rates (by 50 basis points) at the September meeting. However, the downward revision of data from previous months indicates that the Federal Reserve needs to cut rates by at least 75 basis points in total this year." Since the Federal Reserve has three more meetings this year, a rate cut of 25 basis points at each meeting would achieve the aforementioned goal.

For the full-year rate cut pace, data from the CME Group shows that although investors believe there is a higher likelihood of a 25 basis point rate cut by the Federal Reserve in September, they are actually betting that the Federal Reserve will cut rates by a total of 100 basis points or more by the end of the year.

Shenwan Hongyuan Securities believes that the pace of the Federal Reserve's rate cuts for the year is: 25bp + 25bp + 25bp. It points out that the pace of the Federal Reserve's rate cuts depends on the underlying economic fundamentals. The way the economy "lands" determines the downward slope and space of U.S. Treasury yields. In a recession scenario, the Federal Reserve would cut rates by a larger margin. The direction of inflation is the main contradiction in the shift of the Federal Reserve's policy stance. If the forces driving the rebound in inflation are temporary, then the rate cut trade is more likely to be repeated rather than reversed.